Clingendael Policy Brief, June 2025

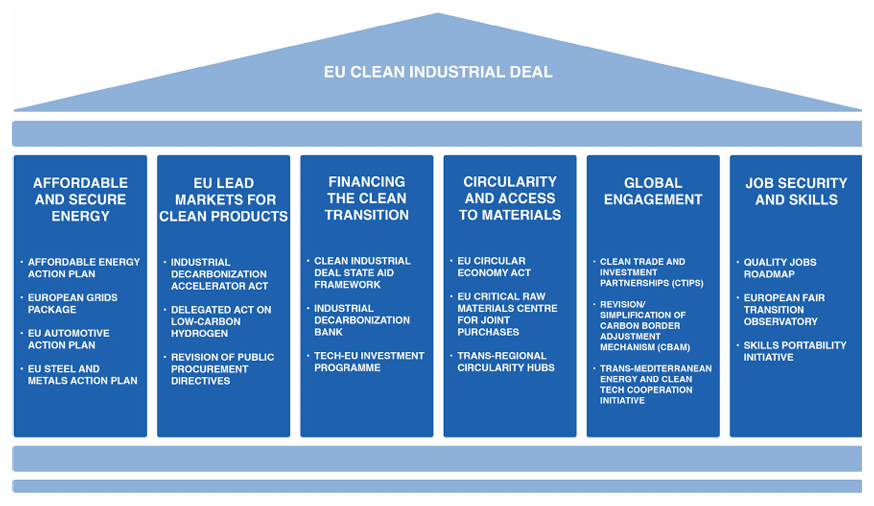

The European Commission’s Clean Industrial Deal (CID) seeks to accelerate industrial decarbonization, reduce reliance on fossil fuel imports and reinforce economic resilience through stronger technological innovation. Part of this strategy concerns boosting industrial production at home, but with reduced dependency on imported fossil fuels. Enhanced domestic manufacturing is also needed to ramp up Europe’s defence capabilities.

At the same time, Russia’s invasion of Ukraine in 2022 fundamentally altered European energy relations, accelerating shifts away from Russian pipeline gas but increasing reliance on other gas supplies, particularly of liquefied natural gas (LNG) from the United States, Norway and Algeria. While this supply diversification has mitigated immediate energy insecurities, it has exposed the EU to new geopolitical risks, not least because of the volatility of the global LNG market and skyrocketing energy prices, affecting the competitiveness of European industries. In addition, the EU’s need to secure the critical raw materials (CRM) and rare earths needed for low-carbon technologies is prompting policymakers to rethink the EU’s trade relations and industrial strategy, underpinned by the Competitiveness Compass.

This Clingendael Policy Brief explores how partnerships with other countries can support the CID’s objectives. Cooperation for added value around energy and CRM can help to position the EU as a strategic and reliable partner, fostering economic resilience both at home and abroad.

Key Recommendations:

- Develop a credible communications package that highlights the added value of green industrial partnerships with the EU. This narrative should be more honest and pragmatic about the EU’s geostrategic interests in the clean energy transition and explicitly address the key concerns and demands of partners regarding the CBAM, ’extractivism’ and trade protectionism.

- Strengthen green industrial partnerships with countries that hold strategic geographical significance and/or where strengthened partnerships could have a geopolitically stabilizing impact, such as the EU neighbourhood and accession countries (such as Ukraine, Morocco and Algeria) as well as economic middle-powers (for example, Brazil, India and South Africa).

- Develop standardized CBAM-compliance verification in close consultation with partner countries to confirm the carbon content of their exports. Technical standards and certification systems for green products and materials also need to be interoperable and aligned to support the creation of regional markets and ‘clean tech’ clusters, for example for batteries. The CTIPs can include such provisions.

- Increase technology co-development and exchange measures for green energy and industrial production in Global Gateway initiatives to stimulate local capacities around key commodities, such as green iron. To incentivize EU companies to engage in tech exchange and joint ventures, public financial guarantees and risk mitigation (such as via the EFSD+) specifically for green industrial projects in third countries need to be expanded.

- Align fiscal and trade instruments, such as export credit guarantees, more strategically with the CID to support the external activities of European companies. Strengthening EU trade finance is essential to help businesses compete more effectively in green energy and infrastructure projects abroad. The EIB and EBRD can play key roles in this. Revenues from the CBAM could be allocated more strategically for private investments under the Global Gateway and the CTIPs.

- Enhance internal coordination between the relevant Directorates-General (that is, DG INTPA, ENER, TRADE, ENEST, MENA, CLIMA and GROW) and the EEAS to mainstream green industrial partnerships into the decision-making process for international finance, trade and development instruments. Member States could support these efforts through greater involvement in EU-level frameworks such as Team Europe.

This policy brief is published by the Clingendael Institute and is written by Hannah Lentschig, Giulia Cretti and Louise van Schaik. To read the complete paper, follow the link here.